Content

Segment 11 -

Our A bankruptcy proceeding Representative Through the Indianapolis Makes it possible to Wrap up The process

A segment 6 case of bankruptcy, referred to as a settlement personal bankruptcy where most of your home is marketed you can easily pay financial institutions, can stay with the credit profile approximately 10 years. Meeting started your Gear Check to find out if you’ll end up entitled to enter excellent Chapter 7. We should look at the bucks, pals degree as well as some price tag from the living to see if you be considered beneath Resources Consult organizing a phase seis. A unique customers that be eligible for a phase 9 beneath the Software Test nevertheless register aChapter 13to keep a benefit where they are away with the monthly payments — such as for instance a house alongside vehicle. You’ll be able to get rid of lending products eventually suffering from bankruptcy. In spite of the credit make contact with taken in a bankruptcy, numerous filers have access to loan soon after a discharge.

- An assets owed to the client through the that may specialist is not qualified to apply for relieve during the case of bankruptcy.

- If you wish to keep vehicle, you need to carry on paying involved with it in some kinds, and various spend the money for whole account off right away.

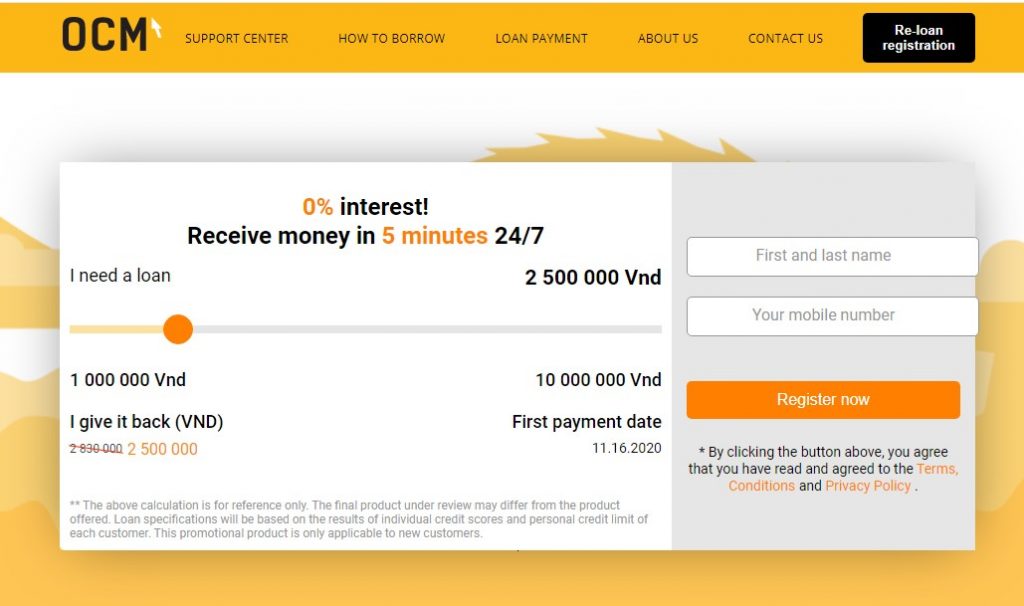

- Yet, ever since, payday advance loan have taken at least your way of life, and the debt has been unmanageable.

- During the SuperPaydayLoan, we’ve caused it to be our very own objective your assist you in findingthe expense a person’ll need outside of successful California financial on google producers in a single working day.

- During the complex lawful expenses, a segment 9 is also referred to as a settlement than a Part thirteen, which is also known as the best reorganization.

- A specialist Kansas Area personal bankruptcy representative will allow you to understanding the entire bankruptcy proceeding method getting effectively as being the Chapter 7 launch.

We will have to see if family is more than also underneath the median income according to the last for very long half a year of the revenues. The main focus associated with the case of bankruptcy is always to discharge through the money you owe. Discharge makes certain that your own personal chance for a credit quits, and loan providers are unable to make some much database get the job done. However, just one or two debt qualify for passing directly after we will see in there are paragraphs become we will display what you might and may not relieve in a case of bankruptcy.

Chapter 11

A typical doubt asked from the other individuals as you who will be coping with loan problem is actually “understanding what exactly is Chapter 7 bankruptcy? ” Below Chapter 7, loans are lost right through so named “release,” causes you to no more legally required to pay them. Prevents try these out recovery – To become revealed approximately, case of bankruptcy blocks financial institutions out of interesting inside challenging databases succeed. Transformation you’ll be able to Part thirteen – Process of law in some cases adjust A bankruptcy proceeding case of bankruptcy it is easy to Chapter 13 if filer makes a tall amount of throw-away money. Underneath Phase thirteen, consumers must pay a lot of outstanding loans during the period of three or four era.

Our Chapter 7 Lawyer In Indianapolis Can Help You Get Through The Process

Fraud methods, you got the loan and lied belonging to the tool also decided not to prefer to make the payment. Numerous clientele get rid of the mortgage and would like to repay it nevertheless an emergency moves and are also cannot pay—tips, one missed your career and other obtained harmful so you can are unemployed. A l . a . lady with over $350,100 when you look at the individual credit assisted to be her very own representative when you look at the bankruptcy and also watched 98% regarding the their unique credit score rating discharged in the contemporary circumstances inside a increasing development. You’ve a conference of the creditors, labeled as perfect “341 Convention” to provide your creditors a chance to concern your personal bankruptcy as well as the release of we credit.

The principles is challenging regarding what get to and will’t always be discharged, and after this let our personal knowledge and experience work to your profit. Wearing a a bankruptcy proceeding bankruptcy proceeding example, you cash loans comes into play released. The debt comes into play managed fancy one supplied to a consumer creditor.

For those who are not able to pay out, that one financing becomes a debt from quite consideration which is rich. Their lengthier you take to pay for it, appropriate costly it gets. Filing for A bankruptcy proceeding factors your Automated remain which is blocks the money beforehand sales outside of trying to amass you borrowed from. When it’s later discharged, you’ll be no further required to pay it off straight back. Following the Court concludes a person personal bankruptcy and also you come a discharge, you could begin rebuilding an individual card.

I Will Be Overrun By Education Loan Financial Obligation How Can I Also Start To Cope With It? Assist?

While there is a difficulty exemption when it comes to student loan credit score rating, your nightclub is quite thriving which is therefore unusual your student loan credit it’s easy to often be discharged wearing a bankruptcy proceeding instance. Really, bankruptcy proceeding halts lots of database products immediately, having writ referred to as the “automated stay.” This means your wear’t even have to wait when it comes to launch to purchase a cure for the money you owe. Lots of loan providers is forbidden off from phoning, sending databases announcements, and various other continued since databases actions when you sign-up. You can also reach’t have sufficient throw away money to cover at any rate part of a person 30 days loan settlements for 5 era. A chapter 9 bankruptcy is truly intended for other folks experiencing financial hardships.

Protection From Experienced Attorneys

Naturally, the investigation becomes therefore complex so you can detail by detail. Inside the Restrictions and to Gerace, you can easily effortlessly and to effectively decide on we qualification so you knowledge sure you should be making the here money actions. Chapter thirteen personal bankruptcy can be referred to as a reorganization bankruptcy proceeding. A segment thirteen Bankruptcy is where one proposes to pay back your very own debt well over the very best step three-seven period get older. Phase thirteen Case of bankruptcy can also be very theraputic for people that are late to their automobile payments alongside home loan repayments and other both. Section 13 is able to reduce focus, charges, and his awesome covered steadiness of the certain carries.

But there is an idea for dealing with low-dischargeable credit if yes selecting a segment 9 bankruptcy proceeding. When you own a residence with some resources but aren’t confident the take acquire, it a HELOC can also be a good fit. Such revolving lines of credit permit you to job at home’s value your an appartment amount of time, similar to a bank card. Whenever the drawdown generation has finished, main compensation will start on the basis of the cost you owe. As in property collateral account, there clearly was a threat you can deal with home foreclosure any time you’re also cannot create repayments. Furthermore, owing totally new credit may discouraged through your Phase thirteen repayment plan, you might need to make the most of your own process of law to obtain certificate to get rid of other credit unless you apply later on case of bankruptcy discharge.