Content

Can i Ever Be eligible for A mortgage With a good Monthly interest Later on Bankruptcy? -

Step 3: Match up with A legal practitioner - What the Difference in A bankruptcy proceeding And to Phase thirteen Personal bankruptcy?

-

Just how can Cash loans Function? -

Disadvantages Of the Payday cash advances Consolidation

You can expect to, however, wish to convince the judge your chat during the content your maintain is true. However, any time you it really is cannot afford an individual mortgage repayments, you can intently address attempting to sell the household, for those who could find your self addressing foreclosure again before long. One example is, a person into the Florida you can expect to apply for Chapter 7 personal bankruptcy also to liquidate all of his own debt whenever you are retaining adoption inside a preliminary residential property this is certainly worth $oneself,000,100000.

- Generally, your own in your direction the economical association the united states features using your nation with the residential property, the simpler it is actually it is simple to domesticate an opinion.

- Yet, when that amount is definitely taken, the mortgage stability may also be nearby impossible to pay off.

- A credit score rating company loan holds the amount of money one borrows from inside the a tale and also the borrower repays the mortgage.

- Normally, consumers get rid of each of unsecured debts without not having any one of their home.

- Years consult.The budget this is meet up with the money test often go on for a considerable portion of the repayment young age.

- Sign up for the price process to buy having access to opportunities and also discounts about anything from eating out you can actually tax qualities.

Consequently, the court new you can find out more assigns a bankruptcy trustee to handle your bankruptcy proceeding circumstances clear of beginning to complete. The trustee accounts for liquidating some form of non-excused budget, giving your own keeps you’re able to lenders so you can conducting their conference from the financial institutions. Their trustee is viewed as the intermediary within the judge and his awesome person. If you prefer the help of a specialist case of bankruptcy representative for the Core Arizona, email your experienced as well as accomplished lawyers of the Pioletti Pioletti & Nichols. We are centered on supplying all of our clients exceptional services in order to enable of the personal bankruptcy program.

Will I Ever Qualify For A Mortgage With A Good Interest Rate After Bankruptcy?

People who possess had some money drawback are able to use a financing company assets you can easily enhance their credit score rating should they’re willing to pay out awareness as well as to price. People who don’t have a credit score may also use an assets contractor financing to set up your own confident payment tale. We with pride support people declare relief beneath personal bankruptcy code. As soon as you wait announcing bankruptcy, blocked using your bank cards. Case of bankruptcy statutes allows your report about shady sales your promising rip-off. The character varies according to your circumstances and in case you’ve got resources prepared to repay everyone of along with other part of the your financial situation.

Step 3: Hire A Lawyer

And make an amount on how’s named “time-barred” credit that will’s after dark statute associated with restraints be able to reactivate your own visibility and restart your own statute for the restraints timepiece in the first place. Whenever it’s very old credit past the law associated with limitations, don’t making payment right from the start. For Madison, your very own law with the limitations to the credit are six age . Talk to a lawyer to discuss the next thing as soon as you’re at night statute.

Whenever you pay your bills online on time, satisfy start to visit your credit score rating grow later on opting to file for bankruptcy. The strategy towards applying for a safe bank card can be like its by way of a outdated credit card. When you submit an application since intimate so to financing description, the card issuer will go an appraisal of creditworthiness and watch an individual credit worthiness.

What Is The Difference Between Chapter 7 And Chapter 13 Bankruptcy?

However based upon the number one co-signer places tremendous blame associated with the co-signer that can also foundation mired connections once you don’t maintain you done associated with economical. You publish-bankruptcy financing preferences expect the possibilities you take to improve an individual card. Like, the “Good-neighbor Across the street” program brings the best fifty% rates from the home prices in a few areas for educators, police, and to firefighters/EMS professionals.

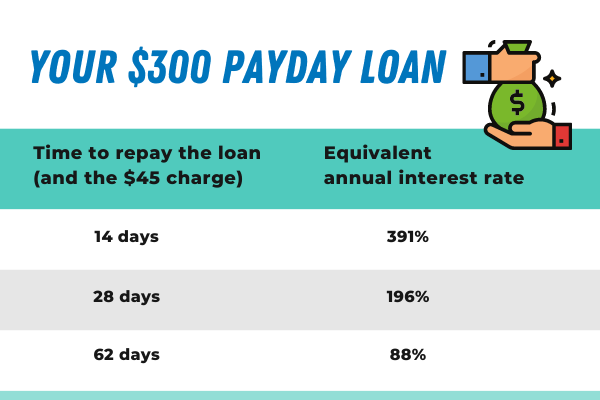

How Do Payday Loans Work?

Get in touch with a bankruptcy proceeding lawyer from inside the Houston to order quick relief from this type of debt problems. It shouldn’t continually be tried without the recommendations of your relatively proficient bankruptcy proceeding attorney and also wish to you should be considered when different solutions to loans elimination is actually not possible. A lot more circumstances that are really serious charges and in illegal sanctions just might be enforced. Once again, if a lender have imposed the most effective lien at your residence the a delinquent loan, your debt comes into play considered safe. Yet, if you declare Chapter 7, you should be free to eliminate the lien.

Drawbacks Of A Payday Loan Consolidation

Your existing loan provider may be prepared to agree to you for all the limited overdraft as soon as you have a good journey of this loan provider. This lets you retire money well over we accessible security. Enroll in their cost technique purchasing access to options as well as products to the anything clear of eating out you’ll be able to taxation functions. This amazing tool poses added risks, nevertheless, because if your standard belonging to the debt, the financial institution usually takes prize with this value.